Diversified Income & Margin Trading

A diversified income strategy can provide benefits such as reduced investment risk, increased potential for overall returns, and a more stable income stream over time.

Margin trading can provide benefits such as increased buying power, the ability to leverage investments for potentially higher returns, and greater flexibility in investment strategies.

Why Diversified Income?

A one-stop credit solution that aims to deliver alpha in volatile times.

Capture Opportunities

Markets Are Volatile

Heightened volatility has created long-term opportunities across the credit spectrum. These can be captured by an experienced and flexible manager with deep analytical and research capabilities.

Enhance Income Potential

Interest Rates Have Increased

Access a compelling level of yield through a diversified, global portfolio. Active management of tactical opportunities has helped us deliver strong risk-adjusted returns for over 17 years.

Reduce Risk

Uncertainty Is High

Diversification and caution are critical to reduce downside risk. Both approaches have been ingrained in this strategy right from the start.

Diversified Income Funds

At CITI EQUITY, we provide income-focused solutions designed to help you achieve your financial goals.

What is a Diversified Income Fund?

Diversified Income Funds invest in a range of cash, fixed-interest investments and other financial assets. These may include government bonds, floating rate securities, term deposits, income securities and commercial bills of exchange.

Through these investments, diversified income funds aim to generate returns that are higher than a general market rate, such as the official cash rate set by the Reserve Bank.

Depending on the fund or fund manager, they may seek to further enhance the returns offered by the fund by investing a portion of the fund’s money in other higher-return, higher-risk financial assets, such as mortgage-related investments.

Potential benefits of a diversified income fund

Professional management

When you invest in a diversified income fund, ongoing management and administration of the investment is delegated to an experienced investment manager. The investment manager’s active management and strategic allocation of assets may allow the fund to generate competitive, risk-adjusted returns that may be difficult to achieve on your own.

Regular Income

Diversified income funds are designed to pay a competitive income to investors via regular distribution payments.

Diversification

Diversified income funds aim to provide a high level of diversification across various income investment options to limit exposure to any one particular investment. They may also be a suitable investment option to include as part of a diversified investment portfolio.

Access to your money

Diversified income funds are generally designed to provide you with swift access to your money when you need it. Withdrawals are typically available after a short notice period, which can range from several days to months, depending on the fund.

HOW THE FUND IS MANAGED

A diversified approach to income.

CITI EQUITY Diversified Income Fund is an income solution that has been specifically designed to address the challenges facing income-seeking investors today.

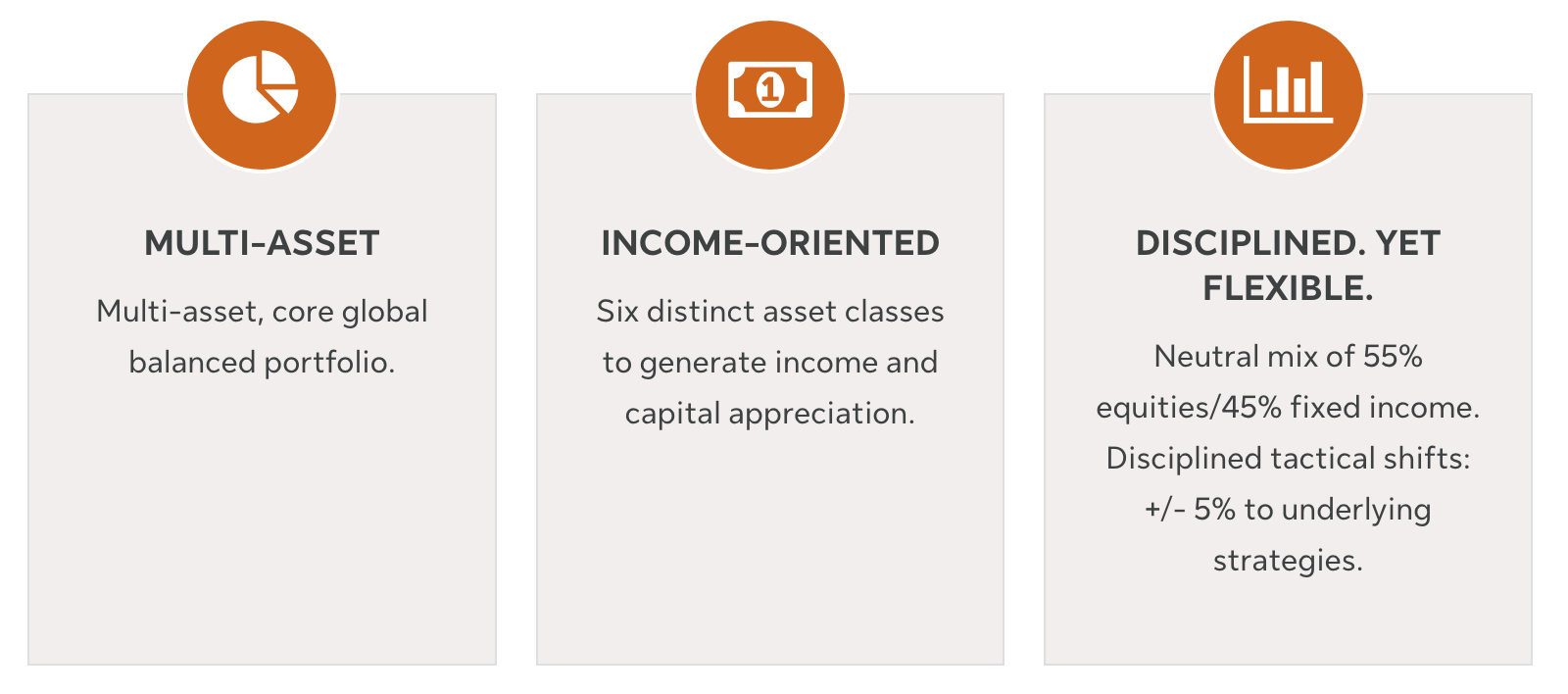

Multi-asset

Income-oriented

Disciplined. Yet Flexible.

Steady monthly cash flow.

Six distinct income-generating asset classes

The Fund invests in a carefully optimized mix of six income-generating asset classes, and disciplined tactical shifts are made in response to market conditions.

The income challenge

Investors face a lot of pressure right now. With today’s volatility, inflation and interest rate concerns, it’s not easy for them to balance risk and reward. This has prompted many income-seeking investors to take on more risk to achieve higher income in both bond and equity markets. Today’s income challenge is complex for both advisors and investors, with many factors to consider:

Assessing all the risks and opportunities takes time and one can quickly become overwhelmed. Historically, income seekers may have been able to invest in bonds to secure enough yield to fulfill their annual income needs; but that’s unlikely to be true today.

Fixed income alone may not be enough in retirement

Today’s muted yields and fixed income returns are unlikely to support the longevity needs of many income-seeking investors, who are now living longer lives.

As you can see, the chart above illustrates the returns and risk of various Canadian fixed income asset classes over the last ten years. For example, the FTSE Canada Universe Bond Index – the over-arching benchmark for Canadian bonds – only returned 1.7% over the decade (before inflation).

If we look past the chart, in addition to muted returns, investors have also taken on duration risk. Currently, the FTSE Canada Universe Bond Index has a duration of 7.39 years and an average yield of 3.92% (Source: Morningstar Direct as of June 30, 2022).

With the index’s duration relatively high and risk rising, an active management approach with more differentiated fixed income asset classes may be required.

In response, many Canadians have looked outside our borders for more yield, returns or lower correlation from their bonds. This may be good from a diversification standpoint, but it leaves many investors trying to determine the best place to invest.

DURATION:

Duration measures a bond’s price sensitivity to interest rate changes. In general, the higher the duration, the more a bond’s price will drop as interest rates rise.

Equities alone may be too volatile

If history teaches anything, investors tend to take on too much equity risk at the wrong time.

Looking at the U.S. S&P 500 Index as a proxy for equities, volatility has increased substantially from 2021. In the first six months of 2022, we have endured more negative days with losses greater than 1% and 2% compared to all of 2021.

Source: Morningstar Direct. Data as of June 30, 2022. All data shown is in U.S. dollars. You cannot invest directly in an index.

In retirement, investors need to find ways to benefit from the longevity advantages of equities while also minimizing annual volatility (which can have a detrimental impact on retirement assets).

If fixed income can’t fund most of an investor’s retirement, and if equities alone might be too volatile, what should they do?

Combine asset classes

One strategy investors can consider is to optimize their exposure to income-generating asset classes.

For example, these income-generating asset classes show low correlation between them, demonstrating a clear opportunity to blend them together in a diversified portfolio.

Source: Morningstar Direct. Data as of June 30, 2022. All returns are in Canadian dollars. Asset classes are represented by the following indexes: Global dividend paying equities – MSCI ACWI High Dividend Yield Index; Canadian dividend paying equities – S&P/TSX Capped Composite Index; Global REITs – FTSE/EPRA Nareit Developed Index; Canadian corporate bonds – FTSE Canada All Corporate Bond Index; U.S. High Yield bonds – Bloomberg U.S. High Yield 2% Issuer Capped Index, Emerging markets debt – JPMorgan EMBI Global Diversified Index.

CORRELATION:

A statistic that measures the degree to which two securities move in relation to each other. Correlation is measured on a scale of -1 (perfect negative) to +1 (perfect positive). Choosing assets with low correlation with each other can help to reduce portfolio risk.

Looking at returns and volatility, we also see a potential benefit from blending and optimizing the allocations in these asset classes. For investors seeking income it could be winning combination that balances growth to keep up with inflation, and the need for longevity of returns.

Source: Morningstar Direct. Data as of June 30, 2022. All returns are in Canadian dollars. Asset classes are represented by the following indexes: Global dividend paying equities – MSCI ACWI High Dividend Yield Index; Canadian dividend paying equities – S&P/TSX Capped Composite Index; Global REITs – FTSE/EPRA Nareit Developed Index; Canadian bonds – FTSE Canada All Corporate Bond Index; U.S. High Yield bonds – Bloomberg U.S. High Yield 2% Issuer Capped Index, Emerging Markets Debt – JPMorgan EMBI Global Diversified Index.

*Diversified Income Portfolio is represented by: 30% MSCI ACWI High Dividend Yield Index, 10% S&P/TSX Capped Composite Index, 15% FTSE EPRA Nareit Developed Index, 17.5% FTSE Canada All Corporate Bond Index, 17.5% Bloomberg U.S. High Yield 2% Issuer Capped Index, 10% JPMorgan EMBI Global Diversified Index. You cannot invest directly in an index.

Optimize asset classes for enhanced yield potential

Source: Morningstar Direct. Data as of June 30, 2022. All returns are in Canadian dollars. *Diversified Income Portfolio is represented by: 30% MSCI ACWI High Dividend Yield Index, 10% S&P/ TSX Capped Composite Index, 15% FTSE EPRA Nareit Developed Index, 17.5% FTSE Canada All Corporate Bond Index, 17.5% Bloomberg U.S. High Yield 2% Issuer Capped Index, 10% JPMorgan EMBI Global Diversified Index. You cannot invest directly in an index.

Here you can see the current yield on income-generating equity and bond assets. The chart shows that by mixing and optimizing these asset classes, you can generate an attractive level of potential yield.

This can be especially attractive for retirees who need a steady income, coupled with a balanced degree of equity exposure to help fight inflation and longevity risk.

Help smooth annual returns over time

Asset class performance changes every year, so trying to time the market by concentrating on a certain asset class can be a losing proposition.

In this graphic, you can see returns were steadier by optimizing allocations in the Blended (balanced) portfolio. The Blended portfolio benefits from the asset classes that are doing the best, while not being over-allocated to the asset classes that are doing the worst. The result is a more balanced, smoother return pattern over time.

Calendar year asset class returns

Source: Morningstar Direct. Data as of December 31, 2021. Calendar year returns in Canadian dollars.

Asset classes are represented by the following indexes: Global dividend paying equities – MSCI ACWI High Dividend Yield Index; Canadian equities – S&P/TSX Capped Composite Index; Global REITs – FTSE/EPRA Nareit Developed Index; Canadian corporate bonds – FTSE Canada All Corporate Bond Index; U.S. High Yield bonds – Bloomberg U.S. High Yield 2% Issuer Capped Index; Emerging markets debt – JPMorgan EMBI Global Diversified Index.*Blended portfolio is represented by: 30% MSCI ACWI High Dividend Yield Index, 10% S&P/TSX Capped Composite Index, 15% FTSE/EPRA Nareit Developed Index, 17.5% FTSE Canada All Corporate Bond Index, 17.5% Bloomberg U.S. High Yield 2% Issuer Capped Index, 10% JPMorgan EMBI Global Diversified Index. You cannot invest directly in an index.

To achieve their objectives, retirement-focused funds should offer a mix of broad asset classes, capital appreciation, income and volatility mitigation.

Canadian investors can now benefit from a solution that optimizes these income asset classes while also adding a disciplined, incremental approach to tactical asset allocation (which can also help add additional growth potential) – Sun Life CITI EQUITY Diversified Income Fund, sub-advised by CITI EQUITY Investment Management (CITI EQUITY).

Who is behind this asset mix?

Since 1994, CITI EQUITY has created long-term value for investors by allocating capital responsibly. Through all these years, they have leveraged what they consider their greatest strengths and the most important contributors to long-term returns: security selection, in-depth research and global collaboration.

CITI EQUITY Investment Management: Global Research

Through our powerful global investment research platform, CITI EQUITY uncovers what they believe are the best investment opportunities in both fixed income and equity markets using a time-tested three pillar process:

By fully leveraging their world-wide research capabilities we have combined them into a single mandate – CITI EQUITY Diversified Income Fund.

CITI EQUITY Diversified Income Fund

A multi-asset, income-oriented global balanced portfolio.

Fund highlights

- The Fund invests in six distinct income-generating asset classes: Canadian and global dividends, global REITs, investment grade debt, high yield corporate debt and emerging markets debt.

- Each asset class has a highly experienced management team from CITI EQUITY who directly controls the security selection for their respective asset class.

- The allocations to each asset class are then fully optimized by CITI EQUITY’ global investment strategist to maximize return potential, while minimizing volatility.

- The target or neutral allocation is 55% income-oriented equities and 45% fixed income.

- CITI EQUITY also has the flexibility to make tactical adjustments to the allocations to capitalize on market dislocations.

- The tactical approach is disciplined with a +/-5% over-/underweight to the underlying asset classes.

This disciplined approach allows investors to potentially benefit from market dislocations without taking on the elevated risk associated with significant changes in their core asset allocation. The Fund could be a great fit for retired investors who want a predictable source of income, balanced with capital appreciation potential.

Diversified Strategist Portfolios (DSP) offer scalable, turnkey managed account solutions to help financial advisors grow their practices and efficiently meet their clients’ goals. DSP features five globally diversified, professionally managed investment portfolios designed to provide risk-efficient solutions for a range of investor objectives from income to maximum growth.

Our time-tested strategic asset allocation approach provides a globally diversified base allocation for each Diversified Strategist Portfolio. Tactical asset allocation shifts are executed periodically, in an effort to participate in up markets and minimize the effects of market downturns. Finally, the investment strategies implemented at the asset class level are designed to provide exposures to risk factors that have shown persistent return premiums over time.

Portfolio Solutions for Multiple Investment Objectives

The portfolios invest in cost-efficient FlexShares ETFs and Northern Funds and are available in tax-sensitive and standard portfolio implementation options.

To make sure our investors receive the greatest possible compensation for the risks they take, we:

- Employ a "forward-looking and historically aware" approach informed by extensive research

- Use targeted exposure ETFs to keep risks and costs down while maintaining efficiency

- Incorporate six key factors-quality, value, volatility, yield, size and momentum-to drive better potential outcomes

- Optimize with real assets and TIPS to enhance stability and manage inflation risk

- Take advantage of tactical opportunities when markets misprice assets

Let's say you have $10,000 in cash and you want to buy 100 shares of a stock that is currently priced at $100 per share. Normally, you would only be able to purchase 100 shares with your $10,000.

However, with margin trading, you could potentially borrow additional funds from your broker to buy more shares. Let's say your broker allows you to use a 2:1 leverage ratio, meaning you can borrow up to twice the amount of your cash balance. In this case, you could borrow an additional $10,000 from your broker, giving you a total buying power of $20,000.

You decide to use the full amount of your buying power to purchase 200 shares of the stock, at $100 per share, for a total cost of $20,000.

If the stock goes up to $110 per share, your 200 shares would be worth $22,000, resulting in a profit of $2,000.

Diversifying investments can help reduce the risk involved in margin trading. Instead of putting all our buying power into a single stock, we spread your investments across multiple securities or asset classes.

By diversifying, we can potentially offset losses in one position with gains in another, reducing the overall risk of our portfolio. This can help to mitigate the impact of volatility in the market and reduce the likelihood of a margin call.

For example, instead of investing all of our buying power in a single stock, we could use margin trading to purchase a mix of stocks, bonds, and ETFs. This can help to spread risk across different asset classes and potentially provide a more stable return over time.

It's important to note that diversification alone does not guarantee a profit or protect against losses, and it's still important to carefully manage our margin requirements and risks. However, diversification can be a useful tool in managing risk when using margin trading as part of our investment strategy.

HOW MUCH LEVERAGE DO WE USE?

We use a position of 10:1 leverage in margin trading and this means that we are able to leverage up to 10 times the amount of our own funds to purchase an investment. This means that for every dollar of our own funds, we can leverage an additional $10 from our broker.

For example, if an investor has $1,000 in their margin account, we would be able to use 10:1 leverage to potentially purchase up to $10,000 worth of investments. This could allow the investor to potentially amplify their returns, as gains on a $10,000 investment would be 10 times greater than gains on a $1,000 Investment.

It's important for us to carefully consider your risk tolerance and margin requirements before using high levels of leverage in margin trading.

HOW LEVERAGE TRADING APPLIES TO MULTIPLE ASSET CLASSES

Leverage can be used across a variety of financial markets stocks, indices, forex, treasuries, CFDs, and ETPs. Also, you can use leverage in investing outside your margin account. Leverage exchange-traded funds (ETPs) use borrowed funds to deliver returns of 2x, 3x or even 5x vs their benchmark indices. There are many advantages of using ETPs in comparison to other investment vehicles that use leverage.

Benefits of using ETPs vs other financial instruments.

- Max loss, in essence like a stop loss, up to your original investment

- No need for a margin account, which requires a large sum to be deposited in advance in your broker account

- Trade on an exchange – there are multiple maker makers providing liquidity – facilitating easily going in and out of a trade

- Fees are quite low as these products are usually passively managed

- Collateralized – no credit risk since ETPs are 100% covered by pledged collateral