Responsible Investing

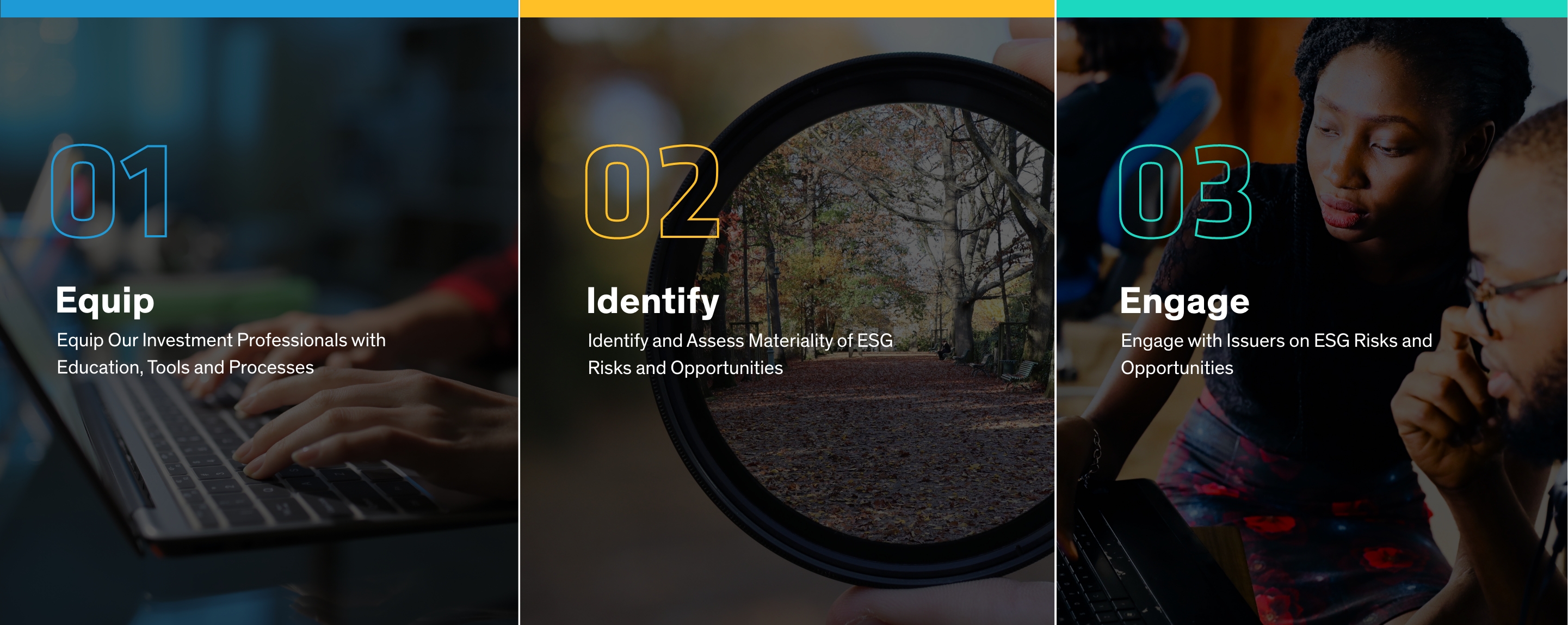

Our Approach to ESG Integration

From idea generation to ongoing stewardship, integrating ESG involves considering ESG risks and opportunities throughout the investment process.

The Active Engagement Advantage

As active investors, engagement is vital to our process. Each year, our analysts engage with leaders of companies and noncorporate entities, including municipalities, supranational and sovereign issuers. We also engage selectively through our proxy voting activities.

These connections allow us to assess, discuss and encourage better business practices and approaches to address rapidly evolving ESG issues. We believe that engagement can drive better research and better outcomes for clients, communities and the world.

How ESG Integration Can Improve Outcomes

ESG risks are often financial risks. With strong ESG research, engagement and integration, we can better assess risks and identify opportunities—the path to improved investment decision-making.

Climate Academy

CITI EQUITY and the Columbia Climate School are partnering to tackle climate change. Together, we hope to research the most pressing climate issues, embed those insights throughout our investment process where applicable and educate others.

Engagement in Action

Chilean Electricity Sector

Power generation is a very capital-intensive industry, and in Chile, is highly dependent on Coal, making companies there reluctant to shutter operational coal plants. Also, many price-sensitive consumers can’t shoulder higher electricity bills to subsidize the transition from coal to renewable methods. We’ve been engaging with the largest four Chilean power-generation companies (AES Andes, Colbún, Engie Energia Chile and Enel Chile) and an electric system financing entity (CHIPEC) to discuss phasing out coal plants and creating innovative ways to finance the transition to renewable energy.

In the first half of 2021, Engie Energia Chile announced that it would close all its coal-powered plants by 2025. AES Andes announced that it would close more than half its coal facilities. To address the issues facing vulnerable consumers amid a short-term period of elevated power prices due to the green power transition, CITI EQUITY engaged with the Chilean government and bankers to develop a creative solution—developing CHIPEC).

CITI EQUITY also engaged with Chile on developing an ambitious carbon emissions reduction plan. Chile became the first sovereign to issue a sustainability-linked bond, with its targets tied to the de-carbonization progress from the utility sector. The key performance indicators of this new bond are stronger than the existing government policies, which positions it close to a 2-degree scenario. Also, on September 30, 2022, Enel Chile announced the closure of its final coal plant—Bocamina II. Enel Chile is the first company among this group to close all of its coal plants, years ahead of its initial commitment. This progress will dovetail AB’s engagements going forward.

Sasol

In support of South African diversified energy company Sasol’s decarbonization efforts, CITI EQUITY continued engaging in 2021 as colead of the Climate Action 100+ (CA 100+) investor cohort. Although Sasol still has a long road ahead to achieve its climate objectives, the company made substantial progress in 2021.

After engaging with Sasol early in 2021, CITI EQUITY and the other CA100+ investors escalated concerns about the company’s decarbonization plans to the firm’s board. In early September, we wrote to the board relaying investors’ expectations for disclosure of its climate strategy, including a suitable transition plan, a clear approach to net zero by 2050, a supporting capital plan and openness about remaining uncertainties.

Later that month, Sasol released robust plans for its net-zero 2050 commitment, new emissions-reduction targets, a decarbonization strategy, capital-allocation plans, a CA100+ benchmark self-assessment and a TCFD statement. It also increased its renewable energy procurement at its Secunda site—the largest single carbon-emitting site in the world—from 900 to 1,200 megawatts by 2030.

In November, CITI EQUITY and the CA100+ cohort met with Sasol’s board to discuss the strategy, its implementation and the financial, political, and operational feasibility of proposed solutions and fossil fuel alternatives. Later that month, management’s nonbinding climate-transition-plan resolution was approved by 96% of shareholders. CITI EQUITY and the CA100+ investor cohort will send a follow-up letter emphasizing the importance of effectively implementing the plan and will continue engaging in 2022.

National Vision

In 2019, CITI EQUITY voted against one of National Vision’s directors: the firm had failed to remove its classified board and supermajority-vote requirement to change governing documents in the year after its initial public offering. The company had other shareholder-unfriendly provisions, including a plurality voting standard, no shareholder rights to call a special meeting or act by written consent, and no proxy access.

We continued to vote against the company in 2020 because the classified board and supermajority voting provisions remained, but its 2020 proxy statement indicated plans to sunset the provisions in 2021. Finally, after several engagements with the company on these governance issues, we saw National Vision reflect our feedback in its 2021 proxy, eliminating its classified board and supermajority voting requirement. The company also published its first corporate responsibility report, which contained a comprehensive materiality assessment and disclosures under both Global Reporting Initiative (GRI) and Sustainability Accounting Standards Board (SASB) standards.

How Does Engagement Make a Difference?

Insight

Engagement generates insight into issuers’ strategies, competitive positioning and how they address risks and opportunities, including potential material ESG considerations. It also helps us assess management, strategy, operations and governance structure. This insight can enhance our research and investment decisions—with the ultimate goal of generating risk-adjusted returns for our clients.

Action

Engagement helps us advocate for our clients’ interests—enabling us to share our ESG philosophy and corporate-governance policies to try to effect positive and sustainable change by issuers. Discussions can focus on strategic, financial, and ESG and climate-related issues, but the goal is always the same: to encourage firms to make decisions with a long-term view that supports positive, sustainable financial outcomes for them, their stakeholders and our clients.

Collaboration

We work closely with nons investors, asset owners and ESG-focused organizations on engagement. Collaboration can happen when we’ve independently arrived at the same conclusion as other managers and believe that working together might help address specific issues. Collaboration can also occur when we believe that issues might be better addressed through a "common ask."

Collaborate, Explore, Advance

Proprietary Research Collaboration Platforms

We’ve innovated platforms that power collaboration between our analysts within and across asset classes as we research and engage with issuers.

PRISM

Our fixed-income ESG research platform, PRISM, provides independent ESG assessments and scores that impact investment decisions. The goal, of course, is straightforward: better and faster information can empower better decisions.

ESIGHT

ESIGHT is a one-stop online shop where our investment teams can access and share proprietary information about corporate ESG practices. We’ve launched several ESIGHT enhancements, including an ESG knowledge center, COVID-19 research and country ESG scores for fixed income.

Finding Responsible Solutions

Responsible investing is a personal journey. Clients may have different environmental and social priorities, and preferences for different investment approaches. To try to meet this need, we’ve developed our suite of Portfolios with Purpose—our ESG-focused strategies.

Year first Portfolio with

Purpose was launched

Dollars invested in

Portfolios with Purpose

Portfolios with Purpose

We manage US$24 billion in Portfolios with Purpose today, one of the most rapidly growing segments of our business. We also manage US$445 billion in assets that use ESG integration and other enhancements.

Responsible+

Achieve additional responsibility objectives, such as climate resilience, ESG improvement or best-in-class allocations. These portfolios adopt a range of strategies to improve management of ESG issues and fall into one of the following three subcategories; Climate Conscious, ESG Leaders and Change Catalysts.

Sustainable

Identify environmental or social challenges presented by the United Nations’ Sustainable Development Goals (SDGs) and target investment in issuers that provide products or services to tackle them. Prominent themes include climate, health and empowerment.

Impact

Invest in issuers that might provide a positive and measurable impact on society or the environment.

UN SDGS: A Road Map for Investors

In recent years, severe weather damage, the global pandemic, and political, economic, and social unrest have made ESG issues more tangible, fueling a global movement around taking responsibility for addressing these challenges.

Sustainable development involves finding solutions to these critical challenges. Directing capital to businesses providing solutions to these issues can provide investors with exposure to fast-growing industries that may help to preserve and, ultimately, increase their wealth.

The United Nations (UN) established the SDGs as a powerful framework of 17 goals to help countries address the challenges of economic prosperity, environmental sustainability and social inclusion. They represent an aspirational view of what the world can look like by 2030. We believe the UN SDGs can help investors connect the world’s crises with actionable investment themes, serving as a road map for translating sustainability issues into investible opportunities.

Based on this mind-set, we’ve developed a practical framework focused on four themes: climate, health, empowerment, as well as strong institutions for sovereigns.

Sustainable Themes

CLIMATE

Efforts to stem climate change are gaining momentum around the world. Many consumers, businesses and policymakers are recognizing the need for change.

- Cleaner energy

- Resource efficiency

- Sanitation and recycling

- Sustainable transportation

HEALTH

Healthcare spending is rising, and people are living longer, which raises complex issues for access to high-quality and affordable medicine and long-term care.

- Access to quality care

- Food security and clean water

- Medical innovation

- Well-Being

EMPOWERMENT

Many sectors of society are marginalized by economic and social forces. Physical and technological infrastructure is needed to enable sustainable economic development, employment growth, poverty eradication and social inclusion.

- Education and employment services

- Financial security and inclusion

- Information and communication

- Sustainable infrastructure

STRONG INSTITUTIONS

Responsible sovereigns provide the foundation for the private sector to innovate and for effective and accountable public policymaking.

- Freedom and fundamental rights

- Anti-corruption and government

- Law and order